Current Japan's economy status and situation

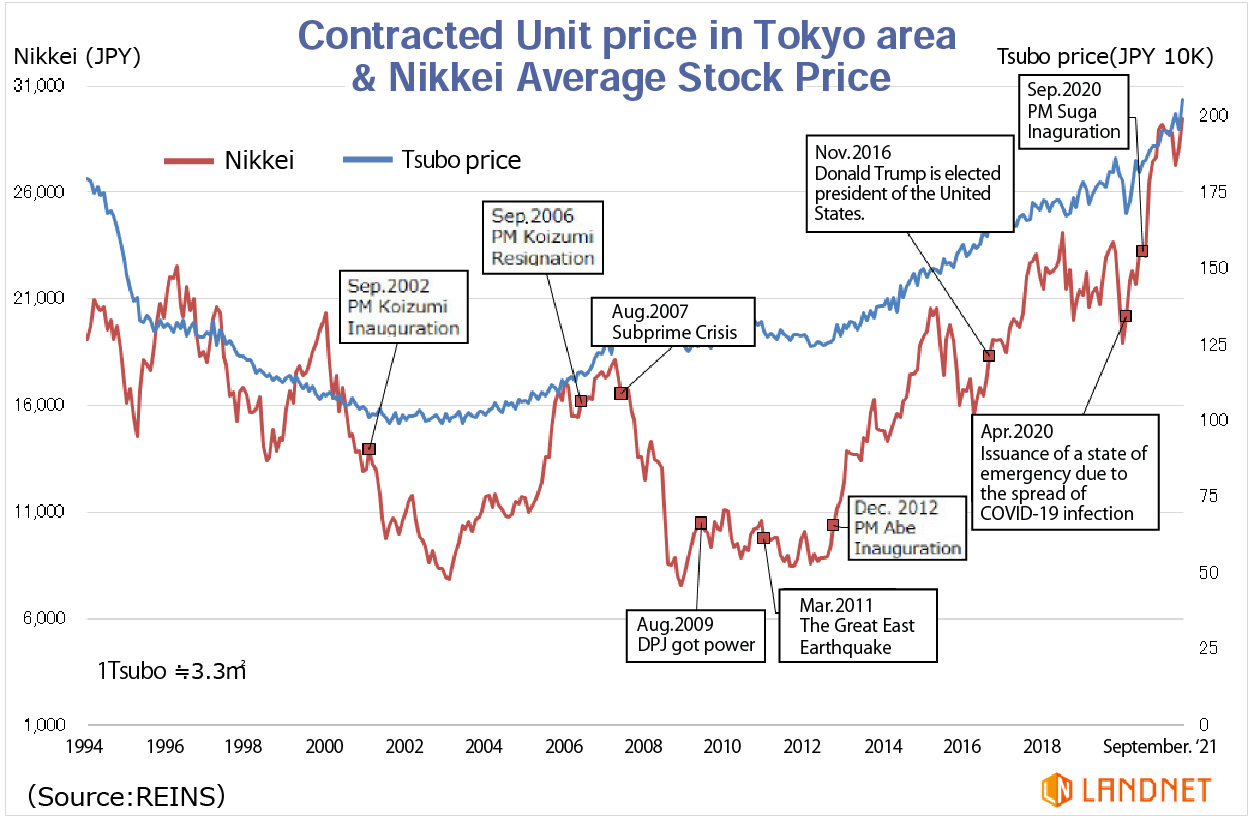

The prices of Japanese second-hand apartments are contracted to the rising of Nikkei average stock price.

Real estate market is turning better①

Have a look at Nikkei stock average price last 2 years

Real estate market is turning better②

For more details, we will explain them in our [Real estate investment seminar]!Click here for more details

Real estate market is turning better③

In this vibrant real estate market, Landnet recommends the properties which meet the following 3 conditions to our investors.

1, Tokyo, Nagoya, and Osaka are central areas of Japan's economy. Their population and economy will keep increasing in the future.

2, Used property - in Japan, usually price will be cut down massively after deliverying new property. Comparatively, used property is cheaper, liquidity is high and demand is strong, so the price is stable. This is the reason why used property could be stable revenue source.

3, One-room property - especially in the above cities, it is said that more and more single residents share living here, so they have strong need for one-room property. Besides, because one-room property is cheaper than other types of rooms, investors can invest in several properties. This is a good way to diversify its risk.

Do not miss perfect chance to invest Japan's real estate!

For more details, we will explain them in our [Real estate investment seminar]! Click here for more details